The early innings of earnings

When the Federal Reserve announced Quant Easing 1 (QE) and Quant Easing 2 (QE2) the stock market was at a low point and investors losses were mounting. In both cases the stock market stabilized after the announcement despite the fact that the program in and of itself did not materially change the economy. QE3, announced last month, occurred not at a stock market low but at it's highest level since 2008. The S&P 500 peaked the day after the announcement of QE3 and the S&P 500 has now fallen 4.1% since the announcement. Throughout the Summer the stock market rallied despite slowing economic growth and slowing revenue growth from U.S. companies. This market rally was based primarily on hope in the Federal Reserve. Now that QE3 is out of the barn the market has focused back on company earnings reports. IBM, Google, Caterpillar, McDonalds, 3M, DuPont, Microsoft and FedEx have been among the companies that have announced disappointing earnings or outlooks.

Slowing growth in China, the European debt crisis and sluggish U.S. economic growth have been cited most frequently. Here is a quick glimpse at some of the details we have learned from recent earnings releases:

Microsoft[i] "Revenue fell 7.9% from the same period last year while Earnings Per Share is down 22.1%"

FedEx[ii] "Earnings for the first quarter were below our expectationsas weak global economic conditions dampened revenue growth, drove a shift by our customers to our deferred services and outpaced our near-term ability to reduce FedEx Express operating costs to match demand levels."

McDonalds[iii] Sales and Earnings down from a year ago. "While our sales momentum and current financial results reflect today's challenging conditions, we continue to see significant long-term opportunities for brand McDonald's and remain confident in the underlying strength of our business model," said McDonald's Chief Executive Officer Don Thompson.

Caterpillar[iv] CEO Doug Oberhelman told analysts that he has "seen a slowing in economic growth more than ...expected", the company cut its 2012 forecast for the second time this year, citing "continued economic weakening and uncertainty." Oberhelman said China and Europe are struggling and the U.S. economy is sluggish.

On to a more positive note...

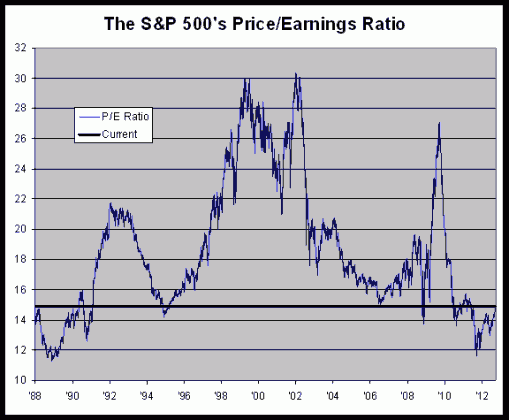

Over the longer-term a good valuation tool for the stock market has been the Price/Earnings ratio. In 2000, for example, the S&P 500's PE ratio hit 30, which was two times the historical average of 15. This was a major red flag that stocks were significantly overvalued at the time.

The more positive note is that today stocks are valued near the historical average of 15. So while there are certainly still many issues that need to be resolved for an increase in sustainable economic growth, the valuation for the stock market as a whole is very reasonable and there are individual stocks whose valuation is attractive.

Source: