Bonds and stocks

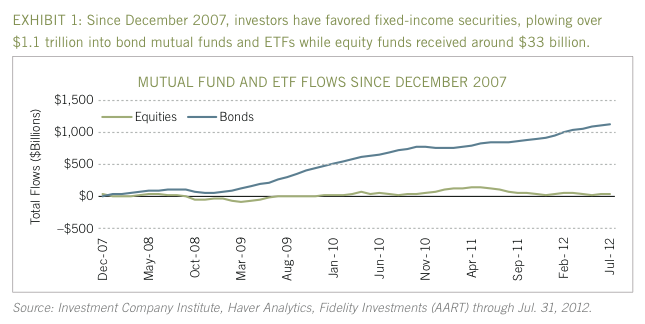

A word on the impact of the election before we dive into our latest update. There continue to be investment opportunities across various areas of the market, as well as areas that are best to avoid. We will continue to closely monitor the financial markets. While Hurricane Sandy and the election have recently dominated news coverage, we wanted to bring to your attention an issue that we have discussed before but have never quantified. It is no surprise that after the 2008 financial crisis investors preferred putting money into bonds over stocks. Typically after significant stock market declines, investors become more conservative for a period of time as the memory of losses linger. What is surprising this time is that going back to 2007 investors have now put 33 times more money into bonds as opposed to stocks ($1.1 trillion vs $33 billion).

We believe that there are a number of reasons for this significant difference. Some investors are trying to be more conservative with the 2008 crisis in the back of their minds.

We also believe aging baby-boomers are shifting more money out of stocks as they age. But a third reason, and more problematic, is some investors are chasing performance. Bonds have had a thirty year bull market and have outperformed stocks over the last ten years. Financial market history has shown when the investing public feels extremely confident in an investment that a dose of skepticism and caution is warranted (ie, tech stocks 1999, real estate 2007). Our experience is that many investors associate bonds with safety and security. However, most investors are unaware of the potential bond market losses in a rising interest rate environment. But not all bonds are created equal.

We exercise caution relating to the bond market by being very specific about which bonds we own. With ultra-low interest rates raising the risks of many types of bonds, we have favored mortgage-backed debt, emerging market debt and investment-grade corporate debt this year. We will continue to closely monitor this space in the future.

We will have another update in the coming week addressing the fiscal cliff, with a slightly different point of view from the majority of fiscal cliff commentary.